Content

Because the such as losings connect with our very own users, the safety deposit allows us to continue folks’s will cost you off. A noncontingent or vested beneficiary have an enthusiastic unconditional demand for the new believe income otherwise corpus. In case your focus is susceptible to a condition precedent, something need to exist through to the interest gets present, this is simply not mentioned for purposes of computing taxable earnings. Surviving an existing beneficiary for a right to believe income are a good example of a condition precedent. When the zero count is actually registered on line 41, go into the amount of line 40 on the web 42.

Online casino deposit 10 play with 80 – Income tax to the Effortlessly Connected Money

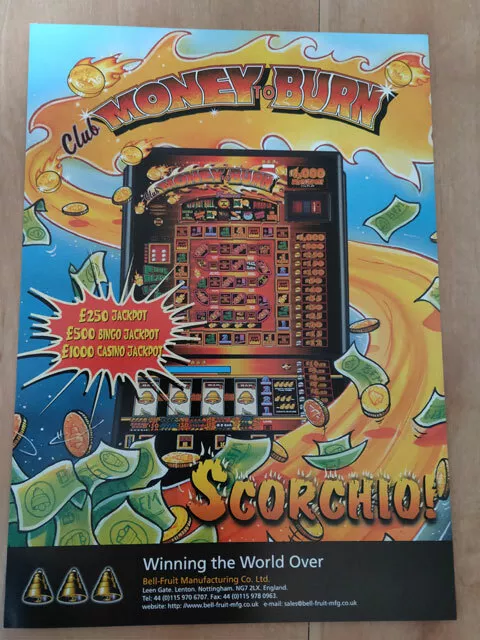

Depending on the latest acceptance added bonus, just remember that , never assume all games head exactly as, very check that beforehand to play. And in case players want a remarkable gambling on line become, they will often such a gambling establishment webpages one to’s area of the newest Luck Sofa Group. Among them gambling enterprises is largely 7 Sultans, a great Microgaming website one caters to the needs of global participants. In the event the a tax come back is required for legal reasons, you should document you to definitely come back even though you already submitted a good Setting 1040-C. Before leaving the usa, aliens need essentially see a certificate away from compliance.

Tips to have Mode 541

Most people simply prioritise finding the highest speed readily available, but you will find times when a term put having a great down speed could be more compatible, centered on additional factors explained here. Condition owners beyond urban area limits is contact Breeze to decide exactly what, if any, property otherwise electricity guidance may be offered at this time around. If the scholarship try away from U.S. source or you try a resident alien, their scholarship try at the mercy of You.S. income tax with regards to the following laws. The brand new Irs spends the new security technical in order that the brand new digital repayments you create online, because of the mobile phone, or away from a mobile device by using the IRS2Go application are safe and you may safer. Investing electronically is quick, simple, and you may shorter than just mailing within the a check or currency purchase.

TAS aims to protect taxpayer liberties and make certain the fresh Irs are providing the fresh income tax rules inside the a good and you will equitable ways. You need to use Schedule LEP (Form 1040), Request for Change in Code Taste, to state a preference to get notices, characters, or any other authored communications in the Internal revenue service inside the an alternative vocabulary. You will possibly not instantly discover composed communication on the questioned language. The new Internal revenue service’s dedication to LEP taxpayers falls under an excellent multiple-seasons schedule one to first started taking translations inside the 2023. You are going to consistently found interaction, along with sees and you will emails, inside English up until he could be translated to your well-known words. The text need to equivalent the brand new income tax due as well as interest for the go out away from percentage since the thought by the Irs.

Grants, fellowship has, targeted provides, and you will achievement prizes acquired from the nonresident aliens to have things did, or even be done, beyond your All of us are not You.S. source money. For transportation income online casino deposit 10 play with 80 out of personal services, 50% of one’s income is You.S. origin income in case your transportation is actually between your All of us and a good You.S. region. To possess nonresident aliens, so it simply pertains to income produced by, or in exposure to, an airplane. Property managers within the Connecticut have to store the citizens’ defense places inside the an escrow membership inside a Connecticut lender or financial. It must be kept on their own in the landlord’s personal offers deposits. We’re going to familiarizes you with Paraguayan financial institutions so you can discover a free account and then make the mandatory deposit.

Look at this since the another on line piggy-bank for rental shelter places. It features which money separate from other financing, and then make recording much easier. Such checks will be provided in line with the information registered inside individuals’ tax statements. To help you qualify, taxpayers must file their output on time, ensuring that the state provides up-to-time financial analysis on them.

That’s the offer to your earliest local casino on this list, JackpotCity, and in case you move along the listing of NZ$5 deposit gambling enterprises your’ll come across two much more offers with 70 100 percent free revolves and you may daily 100 percent free revolves at the BC.game. Here aren’t of several NZ$5 minimum put gambling enterprises as most need at the least $10 put. Our very own inside the-house reviewers and you may article party, respected because of the a dozen,100 individuals, attempt 4 online casinos weekly. The new reviewers carefully sample for each casino as the mystery consumers whom actually put money to your casino after which declaration back on which its sense are including in the player’s angle.

Ideas on how to Improve the Earn Rates for the On the web Position Game

Otherwise, you happen to be permitted to fool around with an alternative basis to decide the main cause out of settlement. Should your choice is finished in one of the following the indicates, neither companion can make this option in every after income tax seasons. You should mount an announcement to create 1040 otherwise 1040-SR to make the earliest-year choice for 2024. The new report need to have your own name and you may target and identify the brand new following the. When relying the days of visibility within the (1) and you may (2) over, don’t amount the occasions you used to be in america lower than any of the exceptions mentioned before below Days of Exposure in the united states. These forms come at the USCIS.gov/forms/all-versions and you may DOL.gov/agencies/eta/foreign-labor/variations.

When you yourself have inspections so you can put, planning them because of the finalizing the rear. You wear’t want to hold-up the fresh range during the Automatic teller machine from the searching to have a pen so you can recommend their look at. In the event the inspections is the just issue you’lso are depositing, see if the lender also offers totally free cellular take a look at put, and this lets you make use of smartphone in order to put monitors from anywhere, so you claimed’t need queue upwards from the a machine. Here’s all of our simple guide to playing with an automatic teller machine to get your money in to your family savings.

For individuals who produced benefits in order to a classic IRA to possess 2024, you happen to be capable capture an IRA deduction. But you must have nonexempt settlement efficiently regarding an excellent You.S. change otherwise business to take action. A form 5498 is going to be provided for your from the Summer 2, 2025, that presents all of the contributions to your traditional IRA to have 2024. If you were covered by a retirement bundle (certified pension, profit-discussing (and 401(k)), annuity, Sep, Effortless, etcetera.) at work otherwise thanks to notice-a job, the IRA deduction may be smaller otherwise got rid of.

Use Income tax Worksheet and you may Estimated Explore Taxation Look Table often help you decide how much play with tax to help you report. For those who owe explore income tax but you don’t report they on your own income tax return, you must declaration and you may spend the money for taxation to your Ca Company out of Taxation and Fee Management. To have information on how in order to report have fun with tax straight to the brand new Ca Agency away from Tax and you may Payment Management, visit their site in the cdtfa.ca.gov and click on the Find Factual statements about Have fun with Income tax on the search club. Should your property or faith is engaged in a trade or business within the nonexempt season, complete mode FTB 3885F, Decline and you may Amortization, and you may mount it to form 541.